Fists in silk gloves

Air Liquide S.A. (OTCMKTS:AIQUY)

— George Baker

HOUSTON, TEXAS, USA, April 12, 2024 /EINPresswire.com/ — “The investment community will regard any forced sale of assets in Mexico as indirect expropriation,” says George Baker, principal author of a new management report.

The report (MEI 980), flags the tenuous situations of Monterra Energy and Talos Energy, both American companies based in Houston, Vulcan Materials, based in Birmingham, Alabama, and Air Liquide, a French company headquartered in Paris. “Each of these companies has faced pressure to surrender control, equity, or ownership of its investments in Mexico,” Baker continues.

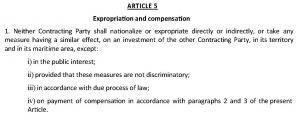

Mexico’s trade and investment protection agreements with the United States, France, and the European Union prohibit direct and indirect expropriation without prompt, fair compensation. The legal figure of indirect expropriation does not exist in Mexico. The expropriation law requires a declaration of public utility, the use of which, according to the report, has been politicized when matters concern foreign investors, especially those in the energy space.

Since coming to office in 2018, the administration led by Andrés Manuel López Obrador has had the goal of clawing back the economic advantages that had been given to foreign investors in the energy sector. He seeks to return those advantages to the two legacy energy companies.

Investors have experienced his intent in different forms. In 2021, the fuel terminal owned by Monterra Energy was closed “at gunpoint” by regulators and the National Guard. In the same year, the government amended the electricity law to disfavor investors in renewable energy.

In 2022, by regulatory dissimulation, the Energy Ministry appropriated half of the commercial rights to a near-giant oil reservoir that were held by a consortium led by Talos Energy. In 2023, Vulcan Materials saw its property occupied without authority but with government approval. At the end of December, Air Liquide México’s hydrogen plant at Pemex’s Tula refinery, in the State of Hidalgo, was declared to be of public utility and was seized by Pemex under an order of temporary occupation.

The government’s decree of February 8, 2024, declared the plant and hydrogen-supply service as matters of public utility, the required legal step before expropriation. “The rationale is badly flawed,” says energy lawyer Juan Carlos Collado, who was interviewed in the preparation of the report. “The decree states that the contracted price of hydrogen is too high when crude oil runs are low, but any shortage of supply is Pemex’s responsibility, not Air Liquide’s,” he insists.

Foreign investors in renewable power generation went to court in unison in 2021 and were rewarded three years later when Mexico’s Supreme Court ruled in February that the electricity law was unconstitutional, as it improperly favored the Federal Electricity Company (CFE), the state-owned utility.

“International investors in the oil space, in contrast, have not yet made use of the Mexican courts,” observes Mr. Collado. “Absence jurisprudence on the evidential rules for a declaration of public utility, the government has a free hand to make up whatever justification it wants, including ones like ‘energy sovereignty,’ for which there can be no empirical evidence.”

In recent years, international investors and their governments have flirted with the idea of international arbitration but have backed off. In July 2022, the U.S. Trade Representative announced its intent to call for international arbitration in view of numerous alleged abuses in several markets in the energy sector (exclusive of the upstream). More than a year passed, and eventually the matter was dropped. Foreign investors in the oil sector are reluctant to voice their grievances in Mexican courts, owing to the risk of reputational damage and the perception that they would be treated unfairly.

“The creation of jurisprudence requires that someone from the oil side goes to court,” opines Mr. Collado. “The rule of law in Mexico will not be strengthened by international arbitration,” he insists. The report concludes that the investor’s risk of indirect expropriation will continue so long as the government’s arguments for the declaration of public utility remain unchallenged in court.

George Baker

Mexico Energy Intelligence

+1 832-434-3928

email us here

Visit us on social media:

Twitter

LinkedIn

Other

![]()

Originally published at https://www.einpresswire.com/article/703081237/mexico-risk-of-indirect-expropriation-flagged-by-houston-s-baker-consultancy